जीडीएस वित्तीय उन्नयन और दिल्ली विशेष अभियान | GDS Financial Upgradation & Delhi Special Drive |

RURAL POSTAL EMPLOYEES

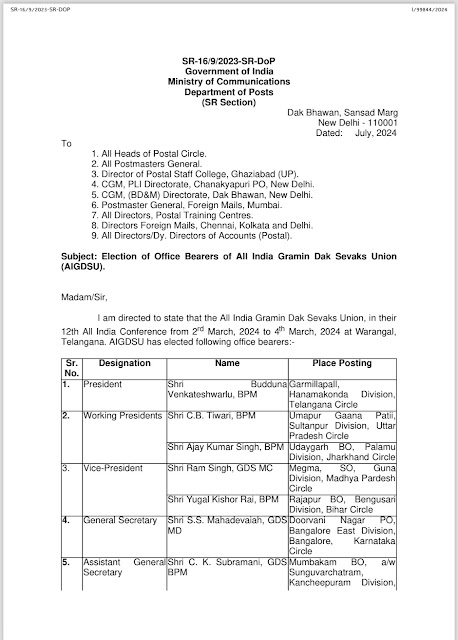

S.S.Mahadevaiah General Secretary, A.I.G.D.S.U. 1st Floor Padam Nagar .P.O. Delhi-110007 Phone-23697701

Wednesday, July 24, 2024

AIGDS CHQ Letter on - Excesses being perpetrated by lower-level officers against GDS for non-fulfillment of given targets.

AIGDS CHQ Letter on - Excesses being perpetrated by lower-level officers against GDS for non-fulfillment of given targets.

Friday, July 19, 2024

Wednesday, July 17, 2024

GDS TO PAs/SAs Postman/Mailgaurd and MTS Promotion 2024 -Regarding.

GDS TO PAs/SAs Postman/Mailgaurd and MTS Promotion 2024.

Tuesday, July 16, 2024

Friday, July 12, 2024

GDS Online Engagement Schedule, July-2024- Descriptive notification and engagement schedule.

The Department of Posts (DOP) has released the GDS Online Engagement Schedule for July 2024. This notification provides detailed information and the engagement schedule. For more details, please refer to the official announcement available at the following link:

Friday, July 5, 2024

Delhi Special Drive, GDS Promotion and GDS Online Recruitment Updates

Delhi Special Drive, GDS Promotion and GDS Online Recruitment Updates.

Thursday, July 4, 2024

Special Drive to fill up the vacant posts of Cader of Postman, Mail Guard, and MTS in Delhi Circle from surplus qualified and willing GDS candidates of LDCE 2022 and 2023 of all circles.

Special Drive to fill up the vacant posts of Cadre of Postman, Mail Guard, and MTS in Delhi Circle from surplus qualified and willing GDS candidates of LDCE 2022 and 2023 of all circles.

Link

https://drive.google.com/file/d/1DT83EZto-4v3TpYzOmq79QKUC5c1CjWT/view?usp=drivesdk

Tuesday, July 2, 2024

GDS Relaxation on Compassionate Appointment &Substitute Arrangements regarding

GDS Relaxation on Compassionate Appointment &Substitute Arrangements regarding.

Monday, July 1, 2024

Saturday, June 29, 2024

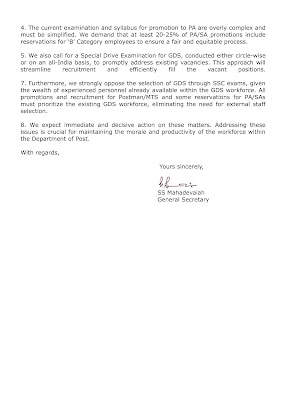

CHQ Letter to DoP on- Urgent Re-assessment of GDS Promotion Policies and Recruitment Procedures-Regarding & Other issues.

CHQ Letter to DoP on- Urgent Re-assessment of GDS Promotion Policies and Recruitment Procedures-Regarding & Other issues.

Thursday, June 27, 2024

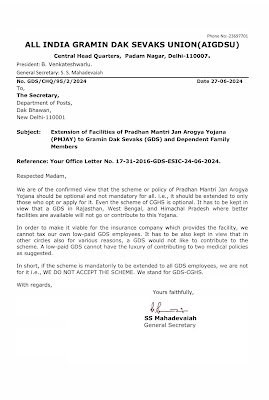

CHQ Letter on-Extension of Facilities of Pradhan Mantri Jan Arogya Yojana (PMJAY) to Gramin Dak Sevaks (GDS) and Dependent Family Members.

CHQ Letter on-Extension of Facilities of Pradhan Mantri Jan Arogya Yojana (PMJAY) to Gramin Dak Sevaks (GDS) and Dependent Family Members.

Thursday, June 20, 2024

General Secretary of AIGDSU, met with the Hon’ble Minister of Communications, Shri Jyotiraditya M. Scindia Ji.

Today, June 20th, 2024, S. S. Mahadevaiah, General Secretary of AIGDSU, met with the Hon’ble Minister of Communications, Shri Jyotiraditya M. Scindia Ji, at his residence.

Hon’ble Minister reflected on previous tenure overseeing the Communications Ministry in 2008-2009, Shri Scindia recalled his initiatives for the Gramin Dak Sevaks (GDS). During his earlier term, he introduced measures such as admission of GDS children to Kendriya Vidyalayas (KV Schools) and infrastructure improvements for Branch Offices, including the provision of umbrellas, slippers, raincoats, and water bottles.

General Secretary congratulated Shri Scindia Ji on his return to the Ministry and presented a memorandum outlining the current state of GDS and pressing issues.

The Hon’ble Minister assured the General Secretary of his commitment to safeguarding the interests of GDS and addressing their issues and grievances.

The meeting was also attended by Ranbir Singh, Ex-Circle Secretary, along with other GDS representatives. The Hon’ble Minister expressed his intention to address the concerns of GDS with empathy and diligence.

Wednesday, June 12, 2024

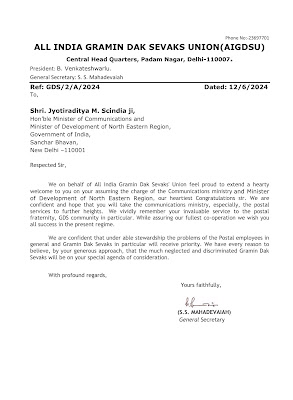

We on behalf of the members of AIGDSU and my own behalf extend a hearty welcome and wish to the Hno'ble MOC.

We on behalf of the members of AIGDSU and my own behalf extend a hearty welcome and wish to the Hno'ble MOC.

We on behalf of the members of AIGDSU and my own behalf extend a hearty welcome and wish to the Hno'ble MOSC.

We on behalf of the members of AIGDSU and my own behalf extend a hearty welcome and wish to the Hno'ble MOSC.

CHQ Letter to DoP On - Urgent Resolution Required for Persistent Issues Faced by GDS Across the Country

CHQ Letter to DoP On - Urgent Resolution Required for Persistent Issues Faced by GDS Across the Country

Monday, June 10, 2024

Thursday, June 6, 2024

DoP Orders on-Condonation of period of irregular retention beyond 65 years of GDS – Delegation of powers.

DoP Orders on-Condonation of period of irregular retention beyond 65 years of GDS – Delegation of powers.

GDS TRCA Upward Revision 1st TRCA to 2nd TRCA: Requirement Details

GDS TRCA Upward Revision 1st TRCA to 2nd TRCA: Requirement Details .

Sunday, June 2, 2024

Friday, May 31, 2024

CHQ Ltter to DoP On - Addressing the Vacant Posts Through Promotion of Eligible GDS Employees and Updating Promotional Policies.

CHQ Ltter to DoP On - Addressing the Vacant Posts Through Promotion of Eligible GDS Employees and Updating Promotional Policies.

Thursday, May 30, 2024

NOC for GDS and Condonation of Breaks in Service for GDS Regarding.

NOC for GDS and Condonation of Breaks in Service for GDS

Wednesday, May 29, 2024

CHQ Letter to DoP On-Urgent Attention Required for Non-Grant of Ex-Gratia Gratuity to GDS Promoted After Long Service.

CHQ Letter to DoP On-Urgent Attention Required for Non-Grant of Ex-Gratia Gratuity to GDS Promoted After Long Service.

Tuesday, May 28, 2024

CHQ Letter to Department on -Non-Drawl of GDS Substitute TRCA (Pay) in Various Circles - Urgent Attention Required

CHQ Letter to Department on -Non-Drawl of GDS Substitute TRCA (Pay) in Various Circles - Urgent Attention Required.

Friday, May 24, 2024

Extension of Prime Minister Jan Arogya Yojana (PM-JAY) to Gramin Dak Sevaks and their families.

CHQ Letter on- Extension of Prime Minister Jan Arogya Yojana (PM-JAY) to Gramin Dak Sevaks and their families.

Tuesday, May 21, 2024

Extension of Pradhan Mantri Jan Arogya Yojana (PM-JAY) to Gramin Dak Sevaks and their family.

CHQ Letter to DoP on-Extension of Pradhan Mantri Jan Arogya Yojana (PM-JAY) to Gramin Dak Sevaks and their family.

Sunday, May 19, 2024

Extension of facilities of Pradhan Mantri Jan Arogya Yojana (PM-JAY) to Gramin Dak Sevaks (GDS) and dependent family members -regarding.

On Extension of facilities of Pradhan Mantri Jan Arogya Yojana (PM-JAY) to Gramin Dak Sevaks (GDS) and dependent family members -regarding.

Saturday, May 18, 2024

GDS Rule-3 Online Transfer Cycle, May - 2024 - Schedule activities - reg.

GDS Rule-3 Online Transfer Cycle, May - 2024 - Schedule activities - reg.

Friday, May 17, 2024

DoP Letter to Unions on - Extension of facilities of Pradhan Mantri Jan Arogya Yojana (PM-JAY) to Gramin Dak Sevaks (GDS) and dependent family members -regarding.

DoP Letter to Unions on - Extension of facilities of Pradhan Mantri Jan Arogya Yojana (PM-JAY) to Gramin Dak Sevaks (GDS) and dependent family members -regarding.

DoP issued instructions on - GDS Rule-3 Online Transfer Cycle, May - 2024 - Schedule activities - reg.

DoP issued instructions on - GDS Rule-3 Online Transfer Cycle, May - 2024 - Schedule activities - reg.

Tuesday, April 30, 2024

May Day Greetings to All

May Day Greetings

To All Our Members,

Readers,

Well

Wishes & Patrons

S.S

Mahadevaiah

Editor & Rural Postal Employees Family

Today All Circle Secretaries, CWC Members, Divisional-Branch Secretaries, and active members requested to submit new membership Declarations to Deprtment.

All Circle Secretaries, CWC Members, Divisional-Branch Secretaries, and active members are requested to make necessary efforts to collect new Membership Declaration Forms in favor of AIGDSU and prepare a list and submit it to the SSP/SP/SSRM officer (Today) on April 30, 2024. This is important, so please take note.

Today to complete this duty of collection and declaration.

Submit the final report with the same information to Circle and CHQ as well.

SS Mahadevaiah GS AIGDSUS

.jpg)